Do you hope to find 'option assignment'? Here you will find all the details.

What is assignment? Associate in Nursing option assignment represents the seller's responsibility to fulfill the terms of the contract by either selling or purchasing the underlying certificate at the example price. This duty is triggered when the buyer of an option contract bridge exercises their rightist to buy operating theatre sell the rudimentary security.

Table of contents

- Option assignment in 2021

- Option assignment fee

- Options early assignment

- Option assignment vs exercise

- Option assignment risk

- Option assignment before expiration

- Call option assignment

- Futures options assignment

Option assignment in 2021

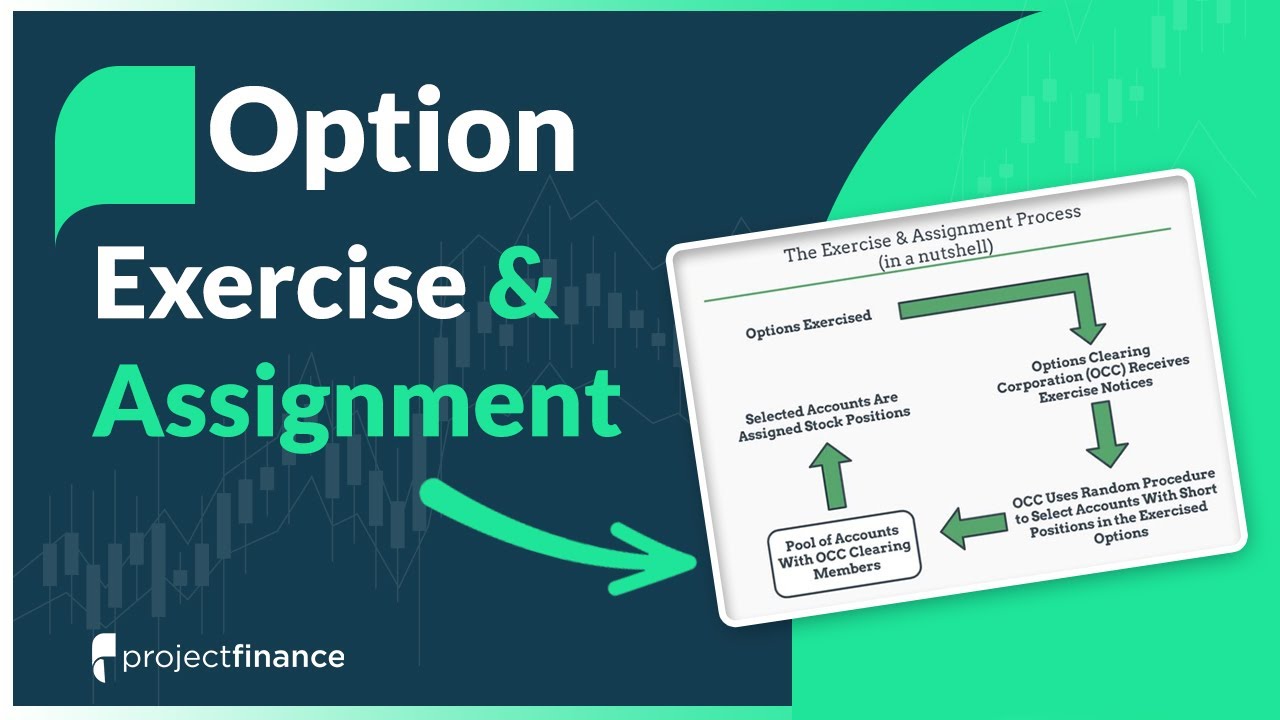

This image shows option assignment.

This image shows option assignment.

Option assignment fee

This picture representes Option assignment fee.

This picture representes Option assignment fee.

Options early assignment

This image shows Options early assignment.

This image shows Options early assignment.

Option assignment vs exercise

This picture illustrates Option assignment vs exercise.

This picture illustrates Option assignment vs exercise.

Option assignment risk

This image demonstrates Option assignment risk.

This image demonstrates Option assignment risk.

Option assignment before expiration

This picture representes Option assignment before expiration.

This picture representes Option assignment before expiration.

Call option assignment

This picture shows Call option assignment.

This picture shows Call option assignment.

Futures options assignment

This picture illustrates Futures options assignment.

This picture illustrates Futures options assignment.

Which is an example of an option assignment?

Examples of an Assignment. For an options assignment, the writer (seller) of the option will have the obligation to sell (if a call option) or buy (if a put option) the designated number of shares of stock at the agreed upon price (strike price).

What is the assignment process for a call and put option?

Hence the name call and put option. The assignment process is the selection of the other party of this transaction. So the person that has to buy from or sell to the option buyer that exercised their option. Note that an option buyer has the right to exercise their option.

When is it bad to get an option assignment?

If the extrinsic value is less than the dividend amount, you really should consider closing the position. Otherwise, the chances of being assigned are high. This is especially bad since being short during a dividend payment of a security will force you to pay the dividend.

What's the difference between assignment and exercise options?

Unlike exercising the option, assignment means they must sell if it is a call and they must buy it if it is a put. In the case of assignments, you would receive an assignment notice when your short options are assigned.

Last Update: Oct 2021