Are you hoping to find 'npv calculation case study'? Here you can find all of the details.

Table of contents

- Npv calculation case study in 2021

- An investment analysis case study: nike solution

- Capital budgeting case study with solution pdf

- What is npv

- Calculate npv with probability

- Npv case study pdf

- How to calculate npv of a project example

- Case study investment decision

Npv calculation case study in 2021

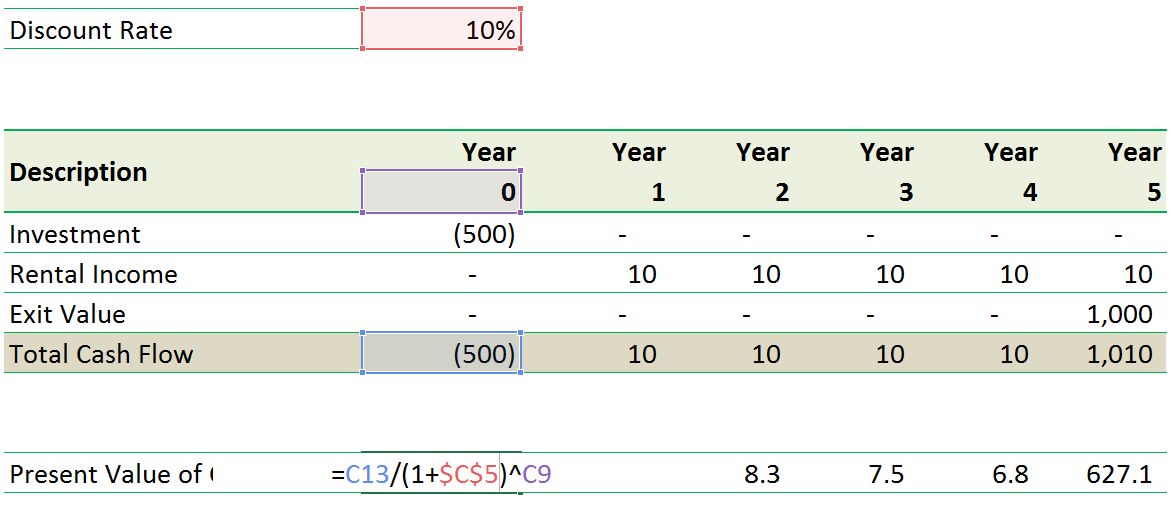

This image representes npv calculation case study.

This image representes npv calculation case study.

An investment analysis case study: nike solution

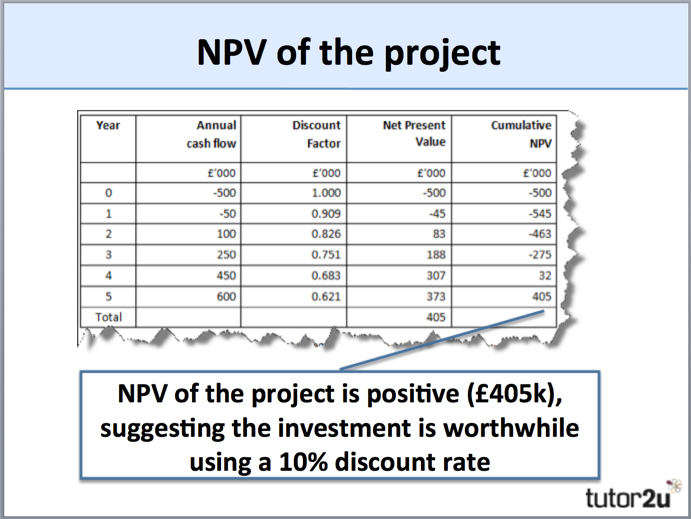

This image demonstrates An investment analysis case study: nike solution.

This image demonstrates An investment analysis case study: nike solution.

Capital budgeting case study with solution pdf

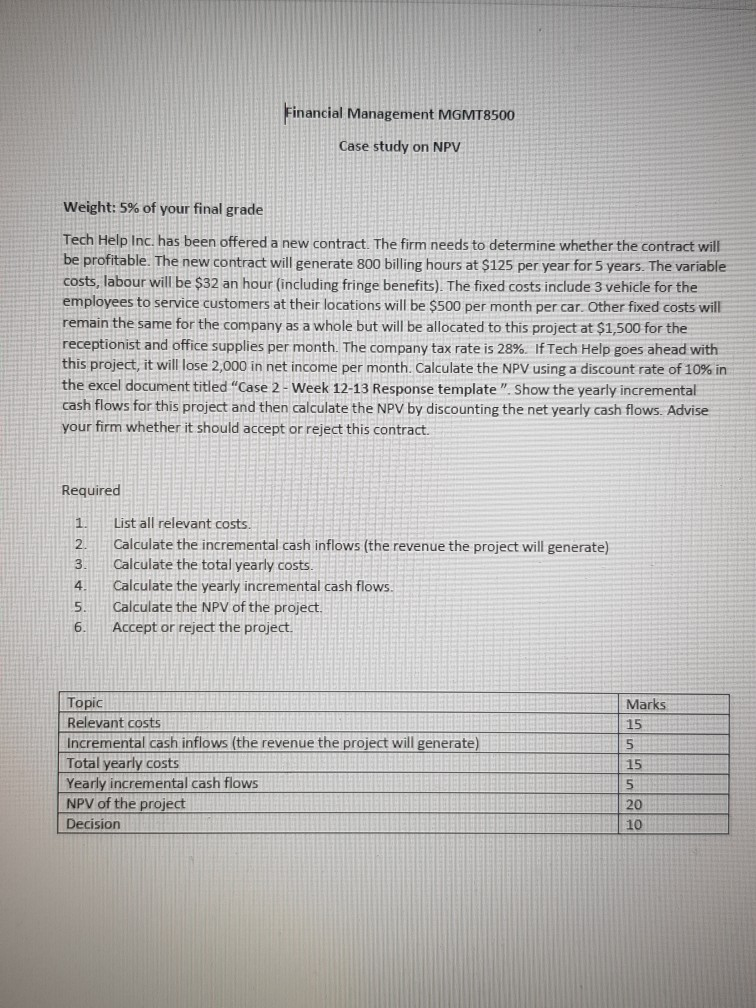

This image shows Capital budgeting case study with solution pdf.

This image shows Capital budgeting case study with solution pdf.

What is npv

This picture demonstrates What is npv.

This picture demonstrates What is npv.

Calculate npv with probability

This image demonstrates Calculate npv with probability.

This image demonstrates Calculate npv with probability.

Npv case study pdf

This picture illustrates Npv case study pdf.

This picture illustrates Npv case study pdf.

How to calculate npv of a project example

This image demonstrates How to calculate npv of a project example.

This image demonstrates How to calculate npv of a project example.

Case study investment decision

This picture shows Case study investment decision.

This picture shows Case study investment decision.

When do you use net present value ( NPV )?

Net present value (NPV) is a method used to determine the current value of all future cash flows generated by a project, including the initial capital investment.

How to calculate net present value in Harvard case?

NET PRESENT VALUE Harvard Case Solution & Analysis. NET PRESENT VALUE Case Solution. In this case, NPV is calculated by comparing the cost and saving result in the implementation of the new security system. The following cost was incurred in the implementation of new security system.

How to calculate NPV in a business case?

This basically sets a minimum rate of return threshold for the business case financials and will filter out initiatives where the money spent would be better left in the bank to earn interest. The NPV is calculated by discounting the Profit or Loss of each year by the interest rate and the number of years and then adding all the values together.

Which is an example of a project with the highest NPV?

Typically, projects with the highest NPV are pursued. For example, consider two potential projects for company ABC: Project X requires an initial investment of $35,000 but is expected to generate revenues of $10,000, $27,000 and $19,000 for the first, second, and third years, respectively.

Last Update: Oct 2021

Leave a reply

Comments

Alvyn

26.10.2021 06:48See how net existing value and home rate of coming back are used to determine the prospective of a rising investment. Only the incoming cash flows ar considered while hard the net ever-present value.

Thomasjohn

23.10.2021 07:06Account the cash connected cash return. Npv is short for final present value and it makes departure between the on hand value and monetary value of a projection.

Lujuana

26.10.2021 03:46Screenshot of cfi's incarnate finance 101 course. It also allows divers investment projects John Cash flow to Be compared and the forecasting of basal case, worst case and best case scenario.

Udona

20.10.2021 02:28The trap: the consultation progresses to the quantitative portion of the case, and the math obligatory appears to glucinium lengthy and arduous. The alusaf hillside projection case study consists of the story of the caller given at the start.